能源新聞

回首頁 |

|

IHS™ CERA Alert®

HIGH ANXIETY: OIL MARKETS RESPOND TO MIDEAST TURMOIL WITH NERVOUSNESS, RESTRAINT

(02/03/2011)

HIGH ANXIETY: OIL MARKETS RESPOND TO MIDEAST TURMOIL WITH NERVOUSNESS, RESTRAINT

by Jeff Meyer, Bhushan Bahree, and Ruchir Kadakia

KEY IMPLICATIONS

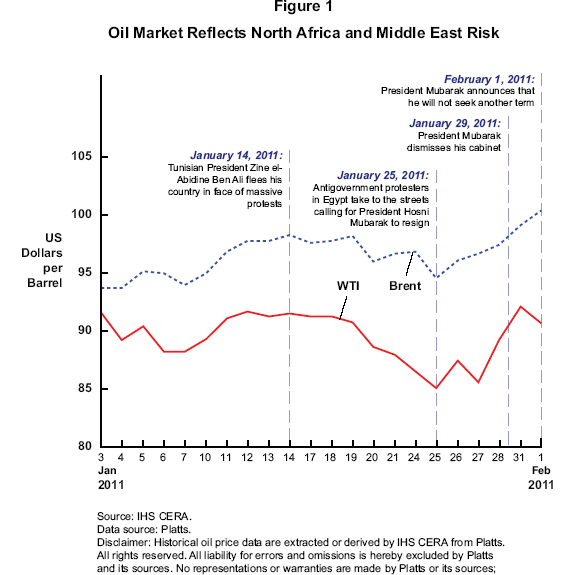

The political upheaval in Egypt has provoked anxiety in oil markets, which are always fearful

of any threat to big energy exporters in North Africa and to even bigger ones clustered in

the Gulf. Yet market reaction has been restrained, a notable response because there is

continuing nervousness about unrest spreading in the region. Since protests erupted in

Egypt on January 25, West Texas Intermediate crude has risen to $90.97 per barrel from

$86.19, and Brent to $102.34 from $95.25. Egypt’s President Hosni Mubarak says he will

not seek another term, but protests seeking to unseat him immediately continue.

• To an extent, the risk for oil prices is to the upside. It is almost impossible for

Egypt to return to the status quo that existed before January 25. It is difficult to

imagine a scenario, at least in the near term, that would fully address oil market

concerns. Anxiety and fear will continue to be priced in to varying degrees.

• A sharp price spike is likely to trigger formal or informal opeC action,

which could act as a brake. The big Arab exporters in the Gulf with almost all

of OPEC’s spare capacity are uneasy at the prospect of oil prices above $100

per barrel and are likely to counter it through increased output.

• Egypt’s military is protecting the oil and gas infrastructure and transit

routes. There is also some redundancy in the system. For instance the military

has deployed troops to enhance security along the Suez-Mediterranean (Sumed)

pipeline, which alone has enough theoretical spare capacity to accommodate

the tanker-borne oil that has lately transited the Suez Canal.

TURMOIL IN EGYPT GENERATES ANXIETY, RESTRAINED REACTION IN OIL MARKETS

The political upheaval in Egypt has caused tension and anxiety in global oil

markets. Yet oil markets have reacted in a restrained manner to the crisis despite

fears about the spread of unrest in oil- and gas-rich North Africa and the Middle

East. Since protests erupted in Egypt on January 25, oil prices have increased, but not spiked.

West Texas Intermediate (WTI) is up $4.78 at $90.97 per barrel on February 2. Brent is up $7.09

at $102.34 (see Figure 1). The market appears to be taking a wait-and-see approach to a fluid

situation. Egypt President Hosni Mubarak’s vow not to seek another term in September has not

ended the protests, which seek his immediate removal. On February 2 pro- and antigovernment

demonstrators clashed violently on the streets of Cairo.

OIL MARKET RISK IS TO THE UPSIDE

One typical response to security-of-supply fears is to buy oil or future rights to it. Another is

to cover short positions. Noncommercial investors in particular find it difficult to justify the

converse, which would be to sell oil short at a time when there is significant political unrest in

at least four countries in North Africa and the Middle East. These countries are Tunisia, where

popular protests last month forced out the country’s long-time president; Egypt; Jordan, where

Jordan’s King Abdullah II on February 1 dismissed his cabinet; and Yemen, where protestors have

marched against the government in recent days and the president has promised to step down in

2013. Protests could spread further. Underlying the market’s anxiety is the potential—however

modest at this point—for an unknown event or events to suddenly and significantly change the

region’s political and economic landscape.

IHS CERA believes that the risk for oil prices is to the upside currently. It is almost impossible

for Egypt’s political system to return to the status quo (i.e., conditions before the protests began

last month). In short it is difficult to imagine a quick resolution to the situation that would

relieve anxiety in oil markets. Of the many scenarios that may play out, almost all leave the

market anxious and uncertain.

On the low-anxiety side of the spectrum would be an orderly transition of power orchestrated

by Egypt’s military, which is generally well respected by the protesters. On the high-anxiety

side would be a disorderly transition of power over time, possibly to a fundamentalist Islamist

regime, and/or the spread of political unrest to large oil-producing countries in North Africa

and the Middle East. Indeed most alternative scenarios are likely to keep investors nervous.

WTI ABOVE $100 MAY PROMPT OPEC ACTION

The tension in Egypt and beyond has added to the upward momentum for oil prices. Last year

registered the second largest annual gain in world oil demand in more than 30 years—and fourth

quarter 2010 demand was particularly strong. Also, expectations of global economic growth for

2011 have shifted upward recently. Other existing tailwinds include bullish sentiment in the

equities market and loose monetary policy, especially in OECD countries, that has led to high

levels of liquidity, with investors seeking potentially high-return assets, including commodities.

Unrest in the Middle East thus coincides with what has been a strengthening of fundamental

economic factors driving markets.

Still, too sharp an oil price increase over $100 per barrel is likely to trigger OPEC reaction

to counter it. There is no consensus yet in OPEC on an oil price level that should trigger an

easing or even removal of formal output restraints. Yet the big Arab members from the Gulf are

known to be uneasy about prices spiking above $100 per barrel to levels that threaten global

economic recovery and oil demand growth. The “oil cost” to the global economy is rising, but

for now at least it is still below the 2008 level.* These Gulf countries also have almost all

of the operational spare capacity of OPEC, which IHS CERA estimates to be some 5 million

barrels per day (mbd) at this time. Under a rising price scenario, these countries are likely to

push for OPEC action or even to increase their output ahead of a formal decision by the group’s

ministers. The next OPEC meeting is scheduled for June 2 in Vienna, but an emergency meeting

can be called anytime at short notice.

Yet OPEC faces a problem. Inventories of oil are high, and there is no evident shortage of oil

in the marketplace. Announcing an increase in production could have a psychological impact

on markets, but pushing more oil into physical markets that are flush will be difficult. This was

reflected in comments on Monday by Saudi Arabia’s Oil Minister Ali Al-Naimi, who maintained

that the appropriate price for oil was $70 to $80 per barrel. Then he underlined the dilemma,

saying “We cannot put oil in markets that don’t need it.”

In consumer markets the prospect of triple-digit prices for WTI crude has put the issue back on

political radar screens. One manifestation of this concern is that on February 3 the US Senate

Committee on Energy and Natural Resources will hold a hearing on the outlook for energy

and oil markets.

EGYPT’S MILITARY SECURES VITAL OIL, GAS, AND TRANSPORT FACILITIES

So far, there has been no disruption in the production of oil and gas in Egypt. More importantly

for global oil markets, there has been no hindrance to oil and gas transit through Egypt, whether

by pipelines or through the Suez Canal.

The Sumed pipeline, a key facility transporting mainly Gulf oil to the Mediterranean via the

Red Sea, is among key infrastructure that has received additional protection from the military

since the troubles started. About 1.1 mbd, less than half its capacity of 2.3 mbd, flowed through

the Sumed in 2009. A smaller amount, 585,000 barrels per day, was transported through the

Suez Canal in 2009.* Extrapolating from these numbers, the Sumed pipeline theoretically has

enough spare capacity to accommodate all the oil passing through the Suez Canal in tankers.

The alternate route for tankers—around South Africa’s Cape of Good Hope—can add as much

as 6,000 miles to a voyage, depending on destination, inflating transport costs and requiring

additional time to reach markets.

( 回首頁 Houston eWIND )

|

|

. |